2025 is shaping up to be a crucial turning point for the implementation of Article 6 of the Paris Agreement on climate change, shifting from complex negotiations to the execution of mechanisms for exchanging carbon credits and emission reduction outcomes between countries. For business leaders and investment funds in Vietnam, as well as international investors eyeing the country’s potential carbon market, understanding these changes is paramount. It not only affects capital costs and competitiveness in global supply chains but also shapes how carbon assets will be valued in the future.

Key decisions at COP29 (Baku, Azerbaijan, December 2024) created a “wave of confidence,” particularly the agreement on methodological and governance guidelines for the centralized credit mechanism under Article 6.4. Concurrently, the deadline for transitioning projects under the Clean Development Mechanism (CDM) to the new mechanism by the end of 2025, and countries beginning to operationalize bilateral agreements under Article 6.2, are fostering a more vibrant and transparent international carbon market.

1. Article 6 of the Paris Agreement – General Framework

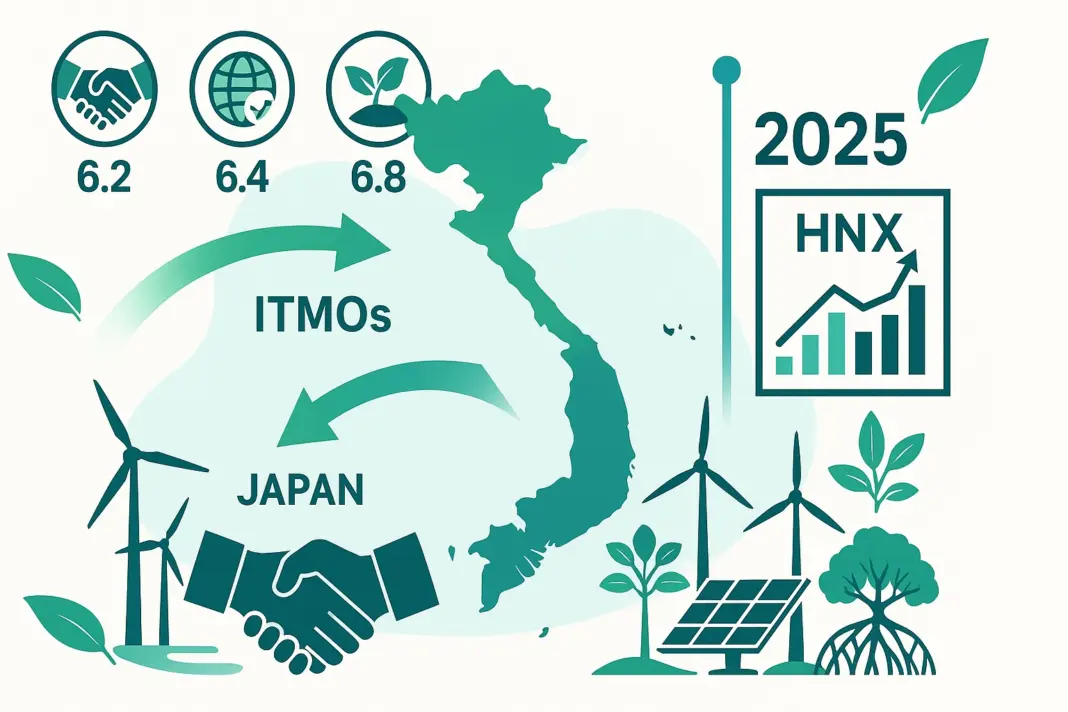

Article 6 of the Paris Agreement provides a framework for voluntary cooperation among countries in implementing their Nationally Determined Contributions (NDCs), aiming to enhance ambition and emission reduction efficiency. It comprises three main pillars:

- Article 6.2: Allows countries to engage in “cooperative approaches” bilaterally or multilaterally to exchange “Internationally Transferred Mitigation Outcomes” (ITMOs). A core requirement is the application of “corresponding adjustments” to the emissions reporting of involved parties to avoid double counting the same emission reductions.

- Article 6.4: Establishes a centralized crediting mechanism supervised by the United Nations, succeeding and improving upon the Clean Development Mechanism (CDM) of the Kyoto Protocol. This mechanism has its own Supervisory Body under the UNFCCC, responsible for approving methodologies, registering projects, and issuing emission reduction credits (A6.4ERs).

- Article 6.8: Promotes non-market approaches, focusing on sharing experiences, knowledge, and best practices in areas such as finance, technology, and capacity building to support countries in achieving their NDC targets.

The relationship between Article 6, the Voluntary Carbon Market (VCM), and carbon pricing mechanisms like the EU’s Carbon Border Adjustment Mechanism (CBAM) is becoming increasingly clear. High-quality standards and requirements for transparency, especially “corresponding adjustments” under Article 6.2 and the standards of Article 6.4, are expected to enhance the value and integrity of carbon credits in both compliance and voluntary markets, creating greater “interoperability” and trust.

2. Latest International Developments

2024 and the first half of 2025 have witnessed significant progress in concretizing Article 6:

- COP29 (Baku, December 2024): The conference achieved important agreements on the technical aspects of Article 6, particularly the adoption of guidelines on methodologies, and management of reversal and leakage risks for the Article 6.4 mechanism. The early consensus from the opening session provided positive momentum for the global carbon market, reinforcing the confidence of investors and market participants.

- SBSTA Sessions (Bonn): Sessions of the Subsidiary Body for Scientific and Technological Advice (SBSTA), notably SBSTA 60 in June 2024, contributed to refining operational rules, including issues related to the centralized Article 6 database and the interplay between Article 6.2 and 6.4. However, detailed information on the outcomes of an SBSTA 60 session in June 2025, particularly regarding the operationalization of the A6 database and 6.2-6.4 interplay rules, was not widely disseminated by early June 2025. These discussions are expected to be further clarified in subsequent sessions and at COP30.

- Article 6.2 Pipeline Statistics (as of May 16, 2025): According to a report by the UNEP Copenhagen Climate Centre (UNEP-CCC), as of May 16, 2025, 98 Bilateral Agreements (BAs) had been signed between 60 countries. A total of 155 pilot projects were recorded, of which 130 projects belong to Japan’s Joint Crediting Mechanism (JCM). This indicates growing interest and commitment from countries in utilizing Article 6.2 tools.

- Market Price and Scale: Although the market is still nascent, “correspondingly adjusted” Article 6.2 credits have begun trading on the OTC (Over-The-Counter) market. Market sources suggest prices ranged between USD 23-30/tonne CO₂e during 2024 and Q1/2025. However, precise verification of this price range and a specific premium of 30-50% over the Voluntary Carbon Market (VCM) as some initial assessments suggested still requires more public and transparent market data. Some forecasts, for instance from Switzerland’s Klik Foundation, suggest ITMO prices could reach USD 20-30/tonne by 2030. There is a general consensus that high-quality Article 6 credits with corresponding adjustments will command higher prices than typical VCM credits.

3. Vietnam’s Legal Framework and Carbon Market Roadmap

Vietnam has been actively building a solid legal framework and a specific roadmap to develop its domestic carbon market, while also preparing for participation in Article 6 mechanisms.

-

Foundational Domestic Laws:

- Law on Environmental Protection 2020: This is the highest legal document, laying the groundwork for carbon market development in Vietnam (Article 139).

- Decree 06/2022/ND-CP (dated January 7, 2022): Details GHG emission mitigation and ozone layer protection, including regulations on GHG inventory (MRV), allocation of emission quotas, and the carbon market development roadmap. It requires large emitters (over 3,000 tonnes CO₂e/year) to conduct GHG inventories biennially, starting in 2025 for the 2024 reporting period.

- Draft Amendment to Decree 06/2022/ND-CP (public consultation announced April 2024): Notably, the Ministry of Natural Resources and Environment (MONRE) has added specific provisions for implementing bilateral carbon credit exchange and offset mechanisms under Article 6.2 of the Paris Agreement. This demonstrates Vietnam’s proactive approach to creating a legal corridor for international cooperation.

-

Market Roadmap and Domestic ETS:

- Decision No. 01/2022/QD-TTg (dated January 18, 2022): Issued a list of sectors and establishments required to conduct GHG inventories (including 1,912 establishments).

- Decision No. 232/QD-TTg (dated January 24, 2025): Approved the Plan for Carbon Market Development in Vietnam, setting out key milestones:

- Pilot Phase (June 2025 – December 2028): Develop regulations for managing carbon credits and carbon credit exchange activities in line with legal provisions and international treaties. Pilot operation of the Carbon Trading Exchange (CTX) managed by the Hanoi Stock Exchange (HNX). Approximately 150 large emitting enterprises, primarily in steel, cement, and coal-fired power sectors (accounting for about 40% of national total emissions), are expected to participate in this phase.

- Full Operational Phase (from 2029): Full operation of the Carbon Trading Exchange.

- The Ministry of Natural Resources and Environment (MONRE) is primarily responsible for developing the National Registry system and coordinating with relevant ministries to determine emission quotas.

-

Draft Decree on the Carbon Trading Exchange (Ministry of Finance, March 2025):

- The Ministry of Finance released a draft Decree regulating the establishment and operation of the national Carbon Trading Exchange on March 25, 2025, expected to take effect from June 1, 2025.

- The draft details participating entities (including enterprises subject to GHG inventory, entities holding carbon credits, other investors, commercial banks, securities companies), tradable commodities (GHG emission allowances and carbon credits verified in the national registry), transaction principles, and the role of the Vietnam Securities Depository and Clearing Corporation (VSDC) in registration, depository, and payment.

4. International Cooperation and Article 6 Credit Channels Related to Vietnam

Vietnam is actively promoting cooperation with other countries to leverage opportunities from Article 6:

-

Japan’s Joint Crediting Mechanism (JCM):

- Vietnam is an active partner in the JCM. As of early 2025, JCM in Vietnam had 14 registered projects with a total average annual emission reduction of approximately 16,990 tonnes CO₂e. (Note: The figures “53 projects, 9 MtCO₂e for the 2021-2030 period” from the initial request could not be verified from official JCM sources for that specific scope and period).

- A recent example is the project “Installation of 2.5MW Rooftop Solar Power System for Food Factory and Garment Factory in Vietnam” (VN019), which had a call for public inputs from January 20 to February 18, 2025.

-

Singapore – Vietnam:

- The two countries signed a Memorandum of Understanding (MOU) on carbon credit cooperation in October 2022 under the framework of the Vietnam-Singapore Green-Digital Economic Partnership.

- Singapore allows companies to use eligible international carbon credits to offset up to 5% of their taxable carbon emissions.

- According to OPIS (March 2025), Singapore has “substantially concluded talks” with Vietnam (along with Bhutan and Paraguay) for ITMO transfers. Singapore’s Ministry of Trade and Industry is also working with Vietnam to finalize an Implementation Agreement on carbon credit collaboration, aiming for it to be the first such agreement between ASEAN countries.

-

Potential MOUs and DNA Status:

- Switzerland: Active discussions are underway between Vietnam and Switzerland for cooperation under Article 6.2, identifying potential pilot projects (EVs, irrigation, biogas, green cooling), with a proposal to draft a cooperation agreement from 2025.

- South Korea: The Vietnam-South Korea Joint Committee on Climate Change Cooperation has met and discussed leveraging Article 6.2, promoting pilot projects, and sharing progress on Vietnam’s domestic legislation.

- Designated National Authority (DNA): The establishment and official approval of Vietnam’s DNA for Article 6 is a crucial step. Currently, information on the final approval status of the DNA has not been widely publicized. MONRE is acting as the focal point for these activities.

5. Opportunities for Businesses and Investment Funds

The carbon market and Article 6 mechanisms open up significant opportunities for businesses and investors in Vietnam:

-

Potential Credit Supply Sources:

- Renewable energy and storage: Wind power, solar power projects (especially rooftop solar for industrial parks), and energy storage systems.

- Biochar and AFOLU (Agriculture, Forestry, and Other Land Use): Vietnam has significant potential from REDD+ projects. The World Bank’s FCPF program disbursed USD 51.5 million to Vietnam for reducing 10.3 million tonnes of CO₂e from REDD+ in the 2018-2019 period. Afforestation, mangrove protection, and biochar production projects are also promising.

- Urban and industrial waste treatment: Landfill gas capture and utilization projects, wastewater treatment, and waste-to-energy projects.

- Energy Efficiency (EE) in industry: Solutions to improve energy efficiency in energy-intensive sectors.

- Carbon Capture, Utilization, and Storage (CCUS): Particularly potential for cement and steel industries. One study indicated that four pioneering CCS projects in Vietnam’s cement industry could mitigate 50 million tonnes of CO₂/year.

-

Credit Demand:

- Domestic ETS compliance: Enterprises subject to GHG inventories will need to purchase emission allowances and carbon credits to meet their compliance obligations, especially when the market becomes fully operational from 2029.

- FDI enterprises with Net-Zero targets: Many multinational corporations with factories in Vietnam (such as Nike, Samsung) are pursuing global Net-Zero goals and may seek to purchase high-quality carbon credits or invest in credit-generating projects in Vietnam. Their active participation in Direct Power Purchase Agreements (DPPA) for renewable energy is an indicator.

- Regional markets: Singapore has clearly expressed its demand for “correspondingly adjusted” Article 6.2/6.4 credits from partner countries, including Vietnam.

-

Investment Models:

- Fund-of-Projects: Funds specializing in investing in portfolios of afforestation, renewable energy, or other emission reduction projects to generate carbon credits and returns.

- Public-Private Partnerships (PPP) with local authorities: Pilot projects like the “Sustainable Development of One Million Hectares of High-Quality, Low-Emission Rice Linked to Green Growth in the Mekong Delta” supported by the World Bank with a potential of USD 40 million from carbon credits serve as an example. Mangrove protection projects in the Mekong Delta could also follow this model.

- Carbon-linked loans/Green bonds with credit conversion options: The development of Vietnam’s green finance market, including green bonds and sustainability-linked loans, can integrate carbon credit-related clauses.

6. Challenges and Risks

Besides opportunities, businesses and investors also need to identify and manage challenges and risks:

- Credit quality and carbon credit risks: Ensuring additionality, accurate measurement, avoiding leakage, and ensuring the permanence of credits are crucial. Projects, especially in the AFOLU sector, can face reversal risks if not managed well.

- International and domestic legal uncertainties: Although the legal framework is taking shape, some technical details of Article 6.4, such as the share of proceeds for the Adaptation Fund and administrative fees, are still being finalized internationally, potentially affecting project economics. Domestically, detailed guidance and consistent enforcement of new regulations also require time.

- Double counting: The risk of double counting emission reductions can still occur if Article 6.2 credits are not rigorously and transparently “correspondingly adjusted” in the accounting systems of the involved countries.

- MRV capacity of Vietnamese businesses: Many enterprises, especially SMEs, may face difficulties in establishing reliable monitoring, reporting, and verification (MRV) systems for emissions due to a lack of experience, resources, and standardized data systems.

7. Strategic Recommendations for Leadership

To seize opportunities and mitigate risks from the carbon market and Article 6, business and investment fund leaders should consider the following strategies:

- Establish an internal Net-Zero roadmap and early MRV system: Proactively develop an emission reduction roadmap aligned with national and international goals. Implement GHG inventory systems according to recognized standards like ISO 14064-1 to ensure accuracy and transparency, preparing for compliance obligations and credit generation.

- Participate in the HNX pilot trading scheme from 2025:

- As an emitter (especially in steel, cement, power, chemicals): Early participation helps familiarize with operational mechanisms, reporting regulations, and carbon management strategies.

- As a credit supplier (projects in agriculture-forestry, renewable energy, waste treatment): Participate to test credit sales, understand market demand, and build credibility.

- Conduct “carbon due diligence” in M&A: When considering investment or M&A opportunities, integrate carbon-related risks and opportunities into the due diligence process. Assign an “internal carbon price” to project cash flows for a more accurate assessment of economic viability in a context of increasing carbon pricing.

- Diversify credit sources and price risk hedging strategies: Avoid reliance on a single credit source. Combine credit generation from domestic projects with exploring opportunities to purchase ITMOs from other countries (if large offsetting needs exist) to diversify portfolios and hedge against price volatility.

- Engage in technical cooperation with experienced organizations: Seek collaboration and advice from reputable international organizations in developing and verifying carbon credit projects (such as Gold Standard, Verra, JCM Secretariat, specialized consulting firms) to ensure the integrity, quality, and traceability of credits.

Thị trường Carbon